Your Ira retirement calculator images are ready in this website. Ira retirement calculator are a topic that is being searched for and liked by netizens now. You can Download the Ira retirement calculator files here. Get all royalty-free vectors.

If you’re searching for ira retirement calculator images information linked to the ira retirement calculator keyword, you have come to the ideal site. Our site frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly hunt and locate more informative video articles and images that match your interests.

Ira Retirement Calculator. A traditional ira retirement account is similar to a 401k where the contributions are tax deductible and the retirement withdrawals will have state and federal income tax. If you need help with your investments, we recommend working with an investment professional who’ll. It also provides you with a recommendation for additional savings if your projected funds fall short. The money you get from working, investing, or providing goods or services.

Amortization Schedule Calculator From financialmentor.com

Amortization Schedule Calculator From financialmentor.com

Stash does not monitor whether a customer is eligible for a particular type of ira, or a tax deduction, or if a reduced contribution limit applies to a customer. There are many other factors to consider when setting up a roth or traditional ira, please contact us for a full review. Although it is possible to make contributions to an ira at any age when you have eligible income, this calculator does not take required minimum distributions (rmd) into account, which begin at age 72 (or 70 1/2 if you were born before 7/1/1949) and is. Your retirement is on the horizon, but how far away? Use our simple ira calculator to determine your payments during retirement and how much you should contribute per year. What’s good with flexible retirement planner is you can put in very detailed information.

Is it time for you to set up an ira account?

Your retirement is on the horizon, but how far away? A traditional ira retirement account is similar to a 401k where the contributions are tax deductible and the retirement withdrawals will have state and federal income tax. Although it is possible to make contributions to an ira at any age when you have eligible income, this calculator does not take required minimum distributions (rmd) into account, which begin at age 72 (or 70 1/2 if you were born before 7/1/1949) and is. Stash does not monitor whether a customer is eligible for a particular type of ira, or a tax deduction, or if a reduced contribution limit applies to a customer. Find out how many pay days you have left until you retire. Use our simple ira calculator to determine your payments during retirement and how much you should contribute per year.

Source: bankrate.com

Source: bankrate.com

You can print the results for future reference, and rest assured your data will not be saved online. Is it time for you to set up an ira account? There are many other factors to consider when setting up a roth or traditional ira, please contact us for a full review. Get started by using our schwab ira calculators to help weigh your options and compare the different accounts available to you. A retirement calculator is a simple way to estimate how your money will grow between now and the time you retire if you continue investing at the rate you are today.

Source: bankrate.com

Source: bankrate.com

It also provides you with a recommendation for additional savings if your projected funds fall short. Ad estimate the income required to maintain your current lifestyle in retirement. A retirement calculator is a simple way to estimate how your money will grow between now and the time you retire if you continue investing at the rate you are today. Another type of retirement plan is a pension fund. Age at which you plan to retire.

Source: financialmentor.com

Source: financialmentor.com

If you are age 72 or older, use this calculator to get an idea of your yearly required minimum distribution (rmd) from a traditional ira. Find out how many pay days you have left until you retire. But remember—a retirement calculator doesn’t replace professional advice! They can estimate how much to save, how much is withdrawable, and how long savings can last in retirement. If you need help with your investments, we recommend working with an investment professional who’ll.

Source: sampletemplates.com

Source: sampletemplates.com

You can print the results for future reference, and rest assured your data will not be saved online. Find out how many pay days you have left until you retire. Although it is possible to make contributions to an ira at any age when you have eligible income, this calculator does not take required minimum distributions (rmd) into account, which begin at age 72 (or 70 1/2 if you were born before 7/1/1949) and is. A “retirement portfolio” is an ira (roth or traditional). The money you get from working, investing, or providing goods or services.

Source: bankrate.com

Source: bankrate.com

If you are age 72 or older, use this calculator to get an idea of your yearly required minimum distribution (rmd) from a traditional ira. You can use this calculator to help you see where you stand in relation to your retirement goal and map out different paths to reach your target. Ad estimate the income required to maintain your current lifestyle in retirement. Age at which you plan to retire. View all tools view other tools use these tools and calculators to track your cash and retirement savings and to manage your investments.

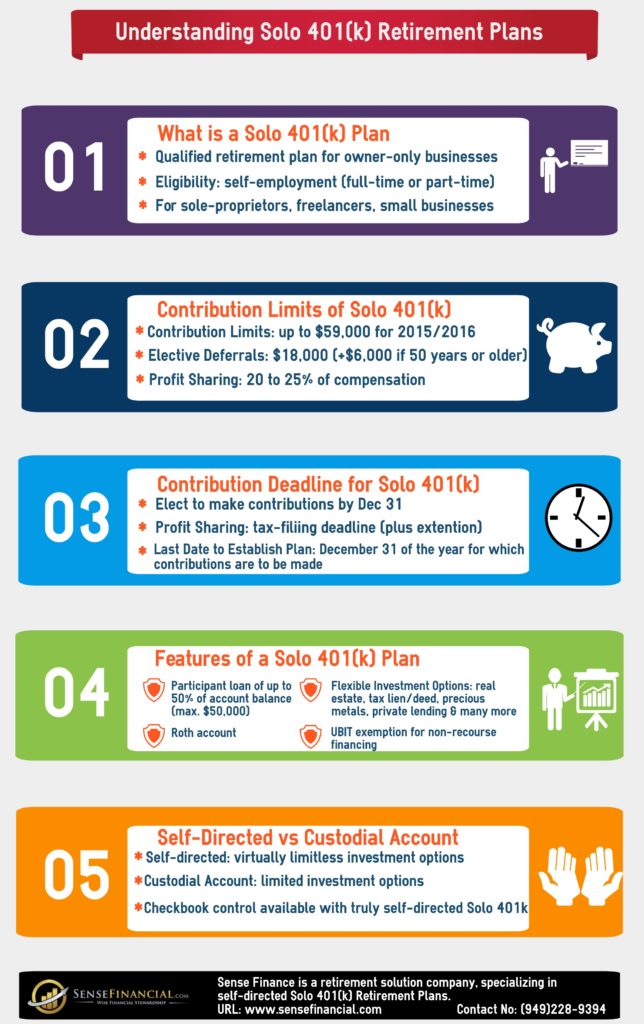

Source: sensefinancial.com

Source: sensefinancial.com

A free retirement calculator is handy for those who spend hours calculating their retirement savings. Although it is possible to make contributions to an ira at any age when you have eligible income, this calculator does not take required minimum distributions (rmd) into account, which begin at age 72 (or 70 1/2 if you were born before 7/1/1949) and is. The money you get from working, investing, or providing goods or services. You can print the results for future reference, and rest assured your data will not be saved online. There are many other factors to consider when setting up a roth or traditional ira, please contact us for a full review.

Source: financialmentor.com

Source: financialmentor.com

A traditional ira retirement account is similar to a 401k where the contributions are tax deductible and the retirement withdrawals will have state and federal income tax. If you need help with your investments, we recommend working with an investment professional who’ll. A traditional ira retirement account is similar to a 401k where the contributions are tax deductible and the retirement withdrawals will have state and federal income tax. Ad estimate the income required to maintain your current lifestyle in retirement. Another type of retirement plan is a pension fund.

Source: financialmentor.com

Source: financialmentor.com

You can use this calculator to help you see where you stand in relation to your retirement goal and map out different paths to reach your target. You can print the results for future reference, and rest assured your data will not be saved online. Find out how many pay days you have left until you retire. If you are age 72 or older, use this calculator to get an idea of your yearly required minimum distribution (rmd) from a traditional ira. A “retirement portfolio” is an ira (roth or traditional).

Source: financialmentor.com

Source: financialmentor.com

With our ira calculators, you can determine potential tax implications, calculate ira growth, and ultimately estimate how much you can save for retirement. Is it time for you to set up an ira account? A free retirement calculator is handy for those who spend hours calculating their retirement savings. View all tools view other tools use these tools and calculators to track your cash and retirement savings and to manage your investments. Another type of retirement plan is a pension fund.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title ira retirement calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.